It also permits companies to automatically set up and manage worker gadgets and apps as quickly as they onboard, which ensures a secure and efficient start for model new hires. Moreover, Rippling offers detailed worker self-service portals that empower employees to handle their particulars, payroll data, and benefits, enhancing transparency and engagement. Companies that rely upon QuickBooks for their accounting needs usually look for methods to streamline payroll management.

Most accountant associate programs are geared toward relatively giant accounting practices with many SMB purchasers. Core payroll software functions can embrace payroll recordkeeping, tax filing and funds, payroll compliance and onboarding help. Workful’s clear pricing helps accountants and purchasers anticipate their payroll prices.

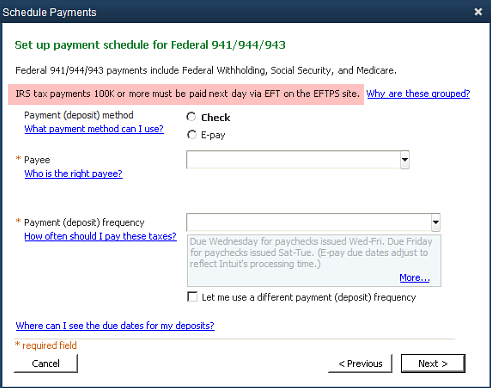

Head to the “Employees” menu in QuickBooks and choose “Payroll Setup.” Comply With the guided prompts that help you input essential particulars like employees, tax IDs, and payment preferences. Well, past saving tons of time, Enhanced Payroll additionally means fewer errors. Guide entries are invitations to errors, and errors can price money. With this tool, you may minimize down on errors considerably as a outcome of it’s set up to catch anomalies earlier than they become issues. Streamlines order success, automates inventory monitoring, and ensures environment friendly delivery management, serving to companies optimize logistics and improve customer satisfaction. It is feasible for customers to discover a want for content-sensitive assistance by making use of right-click https://www.intuit-payroll.org/ menus.

Important Payroll Software Program Options For Accountants

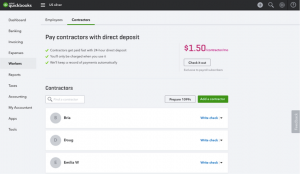

Assure phrases and situations are subject to vary at any time without notice. Each considered one of its packages has full service, which signifies that computerized payroll calculations, payroll tax filings, and year-end reporting are all included on this. The program could be very easy to arrange and it presents quick and direct deposit alternate options (such as next- and same-day payments). Paychex Flex presents payroll software that caters to accountants needing strong, scalable options for companies of all sizes. It offers a comprehensive suite of companies together with payroll, tax administration, and HR, that are adaptable to the needs of rising businesses. ADP’s accountant partners have entry to native sales help, individualized training for his or her team members and co-branded marketing opportunities.

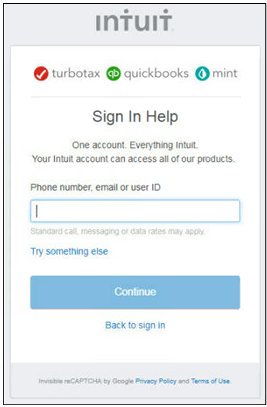

Create State E-file for Massachusetts State W-2, Wage and Tax Statements, has been updated. Whereas I suppose that might work in theory, I really feel like the old accountant could have some issues with it. I’ll provide details about re-adding the deleted Employer Identification Number (EIN) and, if applicable, information you towards the suitable support channels to help you in resolving this matter. When QuickBooks ProAdvisors invoice their firm, they’ll save 30% throughout their client’s subscription. Whether Or Not it’s your first time getting licensed or you’re renewing your ProAdvisor status, you’ll find a way to simply entry self-paced courses, webinars, virtual conferences, and in-person events. I am on hold with them as I type – I am just pissed off – nobody can answer my questions – I truly have 9 clients and two new for subsequent year.

What Pretax Deductions Are Supported By Payroll Software Program For Accountants?

This offers readability on how a selected software program can tackle your payroll challenges successfully. Features embody automated PAYE and NI calculations, RTI submissions to HMRC, pension auto-enrolment administration, and customizable reviews. BrightPay Connect extends performance to the cloud, offering safe online backups, employee self-service portals, and consumer collaboration tools for accountants.

- Papaya World is a cloud-based platform that automates world payroll and payments.

- Accountants with 50 or extra shoppers get a 20% discount and co-branding.

- Remote’s employer of record (EOR) service is intended primarily for large businesses that might profit from its comprehensive administration of a large worldwide workforce.

- It provides instruments for automated payroll processing, tax compliance, and employee management, all within a well-known QuickBooks environment.

- The W-2 employees are given the authentication to log in and view/print their paycheck data which could be initially accomplished only by the admin.

Integrations embody various business instruments, enhancing its capabilities in areas corresponding to employee scheduling, efficiency management, and benefits administration. Rippling’s new integration with Points North automates licensed payroll reporting, guaranteeing compliance with Davis-Bacon and prevailing-wage legal guidelines by synchronizing knowledge in actual time and lowering manual errors. Primarily Based on hands-on testing and industry expertise, I’ve reviewed the top payroll platforms which might be correct, scalable, and tailored to the needs of accounting professionals.

This Disclaimer applies to everyone, together with, but not restricted to, visitors, customers, and others who want to access or use the Website. By accessing or using the Website, you agree to be bound by this Disclaimer. If you disagree with any part of this Disclaimer, then you do not have our permission to access or use the Website.

It provides direct payroll processing, which is built-in with all other HR functionalities, guaranteeing accuracy and consistency across knowledge. Additionally, Paycom’s software facilitates compliance with computerized updates to satisfy altering tax codes and regulations. Options embody computerized tax calculations and filings to ensure compliance with federal and state laws.

Nonetheless, startups and firms with five or fewer accountants can discover cheaper payroll options, similar to Sq and Wave Payroll, that present the necessary features. Still, few competitors can match the options, support and affordability of OnPay’s payroll solutions. When selecting payroll software program for accountants, it is important to suppose about the features that will streamline payroll processes, ensure compliance, and supply strong reporting capabilities.